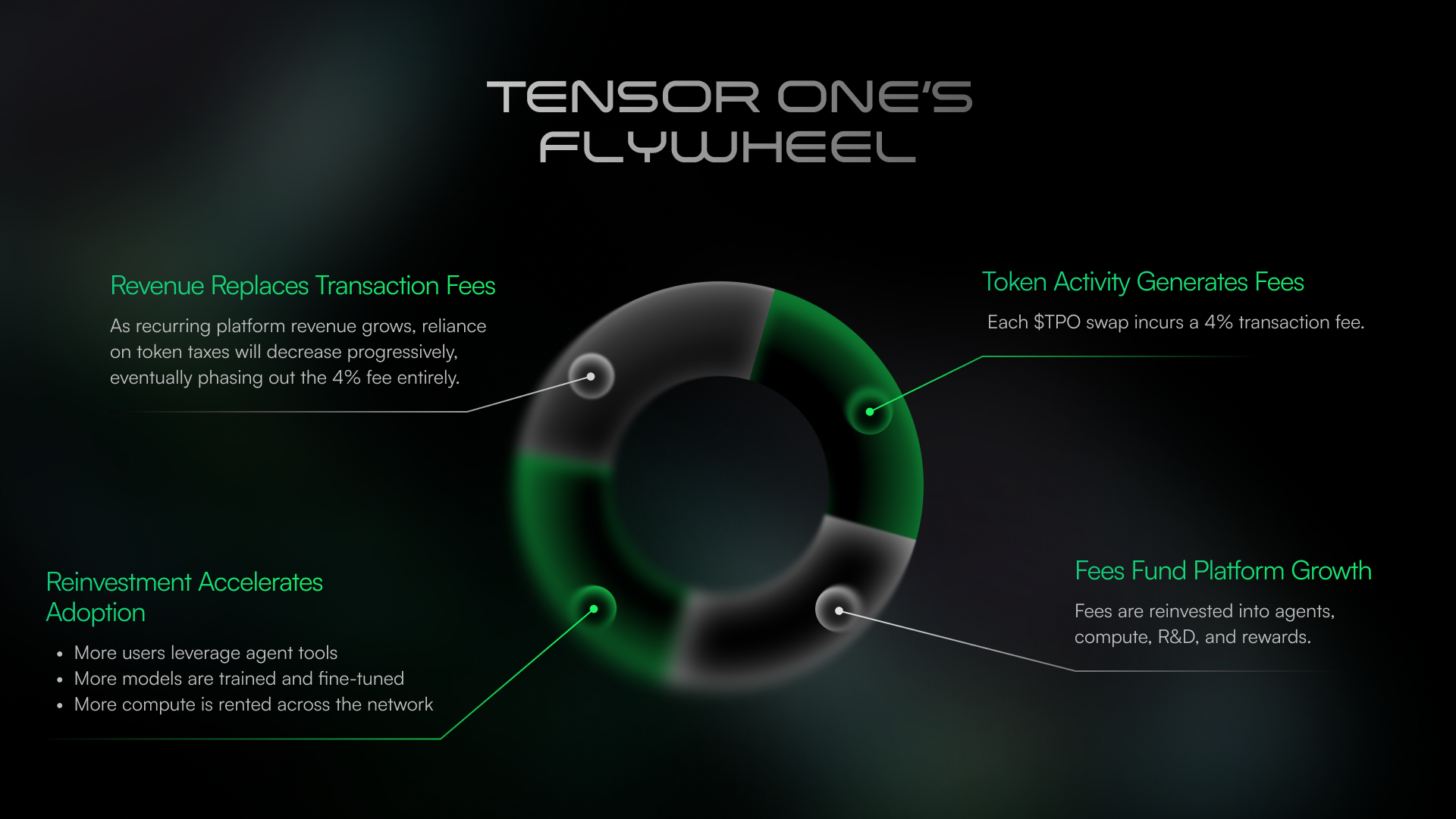

Flywheel Overview

Token Activity Generates Fees

Each $TPO transaction incurs a 4% fee on swap transactions, generating an initial revenue stream that ties platform growth directly to on-chain token volume. This ensures that Tensor One can scale sustainably without relying on external funding.Fees Fund Platform Growth

Collected fees are reinvested into:- Scaling agent infrastructure and compute

- Advancing research and fine-tuning models

- Launching ecosystem incentives and rewards

Reinvestment Accelerates Adoption

As reinvestment compounds:- Adoption of Tensor One’s agent tooling increases

- Model quality improves and becomes more accessible

- Compute utilization grows across the network

Fee Reduction Over Time

The trading fee begins at 4%, serving as an initial revenue stream tied to platform usage. As adoption increases and recurring revenue becomes more reliable, this fee will be gradually reduced, with a target of reaching 0% within 6 months post-launch. Fee adjustments will be informed by:- Platform revenue performance

- Operational cost coverage

- Ecosystem maturity

Flywheel Summary

| Stage | Description |

|---|---|

| Token Activity | Users interact with $TPO, triggering a 4% fee |

| Revenue Accumulation | Fees are collected from protocol usage |

| Strategic Reinvestment | Revenue is allocated to infrastructure, compute, R&D, and incentives |

| Accelerated Adoption | Improved platform utility attracts more users and developers |

| Fee Elimination | Targeted for 6 months post-launch, the transaction fee reduces to 0% |

Why It Matters

This model ensures the protocol doesn’t rely on extractive tokenomics.Instead, it rewards early participation, accelerates meaningful adoption, and phases out transaction fees entirely by aligning long-term incentives with platform maturity.

Key Terms

- Reinvestment – Redirecting on-chain revenue back into product and ecosystem growth

- Self-sustaining – A state where platform usage generates enough revenue to cover operations

- $TPO trading fee – A 4% transaction fee applied initially, designed to phase out entirely over time

Why start with a fee if it will eventually be reduced?

The initial fee creates a self-sustaining revenue loop to support infrastructure and reinvestment. As usage grows and revenue becomes consistent, the fee will be reduced in phases with a target of 0% within six months post-launch, assuming platform operations are fully self-funded.